2026 data shows modern Non-QM loans are safer, with strong credit, low LTVs and resilient borrowers driving growth and approvals at Truss Financial Group.

CALIFORNIA (CA), CA, UNITED STATES, February 11, 2026 /EINPresswire.com/ — For years, the term Non-QM (Non-Qualified Mortgage) carried a stigma, often tied to memories of subprime lending from the mid-2000s. But the market has evolved. As we move through 2026, new performance data confirms that modern Non-QM loans are designed with tighter guidelines, better borrower profiles, and significantly lower risk.

Today’s Non-QM loans are no longer viewed as a niche product; they represent one of the fastest-growing segments of the mortgage market. At Truss Financial Group, a leader in alternative mortgage solutions, performance data and industry trends indicate that modern Non-QM borrowers frequently demonstrate stronger cash flow, larger reserves, and lower default risk than many traditional bank borrowers.

The Numbers Speak Themselves: Why the Risk is Gone?

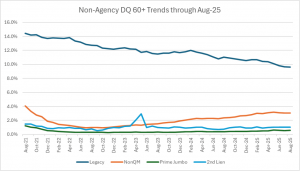

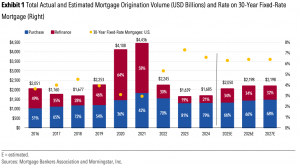

Recent industry analysis, including DBRS Morningstar’s 2026 Sector Outlook, points to a stable and well-anchored foundation for non-bank mortgage providers, even as other parts of the economy feel the effects of sustained high interest rates. The Non-QM space, in particular, has shown notable resilience amid these pressures.

“When people hear ‘alternative lending,’ they often assume we’re taking big risks,” said Jason, Chief Marketing Officer of Truss Financial Group. “But the data tells a very different story. While the national delinquency rate for first-lien mortgages hovered between approximately 3.9% – 4.0% in late 2025, Non-QM loan performance has remained strong. Our focus isn’t on risky borrowers, it’s on complex ones.”

Recent performance trends further illustrate how today’s Non-QM borrower differs from outdated stereotypes:

1. Strong Credit Profiles: Modern Non-QM borrowers typically carry credit scores near 700 or higher, well above the 620 minimum often accepted for conventional loans.

2. Substantial Equity: While many government-backed programs, such as FHA, have average loan-to-value (LTV) ratios near 97%, Non-QM borrowers at Truss Financial Group typically qualify with LTVs around 75% (requiring a 25% down payment).

3. Significant “Skin in the Game”: Today’s alternative borrowers are bringing meaningful capital to the table. In fact, our borrowers’ average down payment is closer to 34%, a level of equity that provides a strong financial buffer beyond what many traditional products require.

The Bank-Statement Revolution

The primary driver behind the Non-QM boom is the shift in how Americans work. With nearly 30% of the workforce now operating as self-employed, freelancers, or business owners, the standard W-2 paystub is becoming an endangered species.

Truss Financial Group has leaned into this shift, offering products that cater to these paperwork-challenged but asset-rich buyers. Their Bank Statement Loans allow self-employed buyers to use 12 or 24 months of business deposits to prove income.

“If you’re a business owner, your tax professional’s job is to make your income look as small as possible to save you money,” Jason explains. “A traditional bank looks at those tax returns and says ‘no.’ We look at the actual cash flow, which often shows six or seven figures in annual deposits, and say yes.”

Diversifying the Portfolio: What Truss Financial Group Offers

As the market stabilizes, Truss Financial Group is expanding its suite of Non-QM products to ensure that every type of non-traditional buyer has a seat at the table. In 2024, Truss was able to approve 81% of applicants, while traditional lenders often deny nearly 47% of those who don’t fit the perfect box.

1. Bank Statement Loans: Use 12–24 months of deposits. Available for Jumbo loans up to $10 million with no tax returns required.

2. DSCR Loans (Debt Service Coverage Ratio): Perfect for real estate investors. If the property’s rent covers the mortgage, the loan is approved, no personal income verification needed.

3. Asset Depletion Loans: For high-net-worth individuals with significant liquid assets but no job.

4. 90% LTV Non-QM: Allowing strong borrowers with 650+ credit scores to enter the market with as little as 10% down.

A Data-Driven Future

The DBRS Morningstar report highlights that while the mortgage industry has faced headwinds, the foundation is being poured for a stable 2026. For home buyers, this means Non-QM is no longer a fringe product; it is a vital financial tool.

The risk in the mortgage market today isn’t coming from the borrower who uses a bank statement loan; it’s coming from a rigid system that refuses to evolve. Truss Financial Group is leading that evolution, closing traditional loans in as little as 10-14 days and complex Non-QM files in an average of 36 days.

We want home buyers to know that if the bank said ‘no,’ it’s likely not because of your finances, it’s because of their outdated rules, says Jason. The data proves you’re a great bet. We’re just the ones willing to take it.

About Truss Financial Group

Truss Financial Group is a premier mortgage brokerage specializing in alternative lending and Non-QM loan products. Based in California, Truss Financial Group helps self-employed borrowers, real estate investors, and high-net-worth individuals secure financing that traditional banks often miss. By working with over 90 different banks, Truss provides more options and higher approval rates than traditional lending institutions.

Jason Nichols

Truss Financial Group

+1 888-878-7715

jason@trussfinancialgroup.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

TikTok

X

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]() Topic / Business & Economy, Topic / Social Media, Topic / Banking, Finance & Investment Industry, Topic / Media, Advertising & PR, Topic / Real Estate & Property Management, Country / United States, State / California

Topic / Business & Economy, Topic / Social Media, Topic / Banking, Finance & Investment Industry, Topic / Media, Advertising & PR, Topic / Real Estate & Property Management, Country / United States, State / California

Be First to Comment